2023 Annual Bulletin

Electronic Warehouse Receipt Market 2023 Bulletin

TMEX EWR Market recorded a trading value of 182 billion Turkish Lirassince the commencement of its operations.

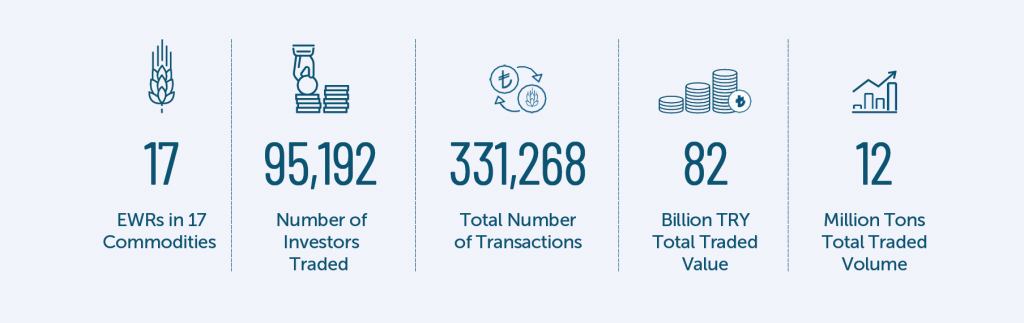

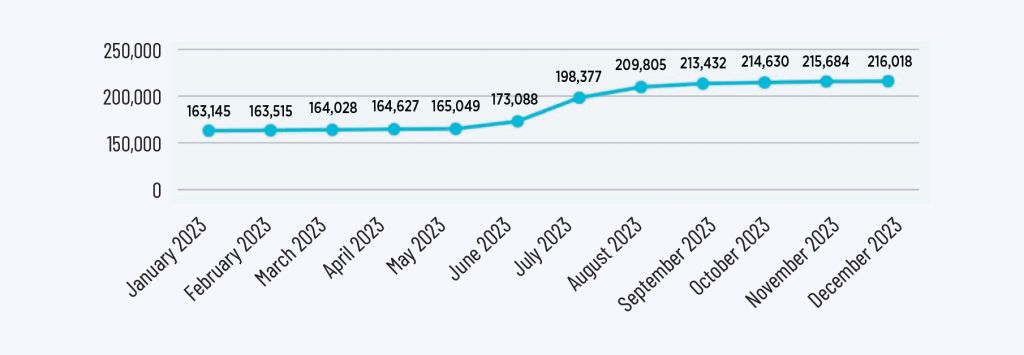

Turkish Mercantile Exchange (TMEX) has launched its Electronic Warehouse Receipt (EWR) Market on July 26, 2019. In 2023, EWR Market reached a trading volume of 12 tons and a total trading value of 82 million Turkish liras in more than 331 thousand EWR transactions. Since TMEX commenced operations, it has recorded more than 1 million EWR transactions, with over 216 thousand registered investors a trading volume of 40 million tons and trading value of 182 billion Turkish Liras.

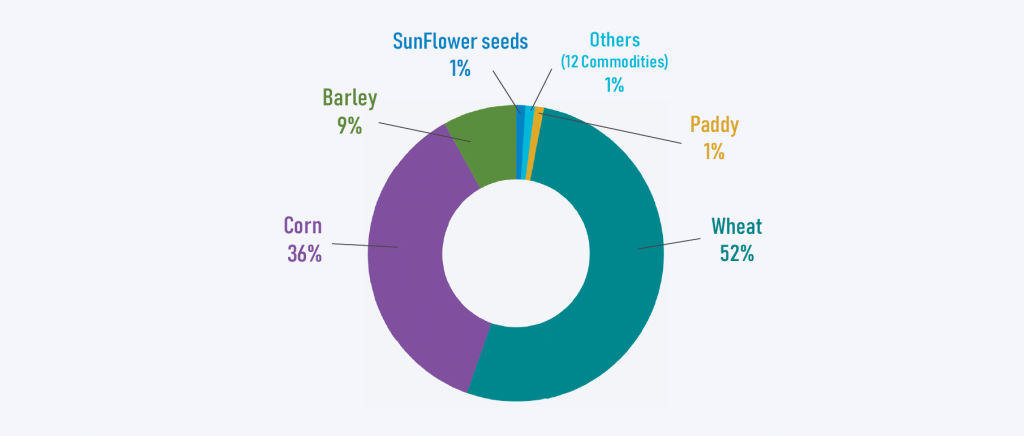

EWR is an electronic receipt that represents agricultural products stored in licensed warehouses and can only be traded in TMEX EWR Market. The market primarily trades grain such as barley, wheat, and corn. 17 distinct products including grain, legumes, oilseeds, pistachios, hazelnuts, dried apricots, cotton, and olives are tradable in the TMEX EWR Market.

A licensed warehouse, where the actual products represented by EWRs are stored, is one of the pillars

of commodity trading systems. In Türkiye, 186 licensed warehouses provide service in 45 provinces, 136 districts and 261 di erent locations with a storage capacity of 10 million tons as of the year-end 2023. The total licensed warehouse storage capacity, which used to be 4 million tons when TMEX commenced operations, increased greater than 2.5-fold in 4 years, reaching to a capacity potentially storing one-fourth of Türkiye’s total grain harvest.

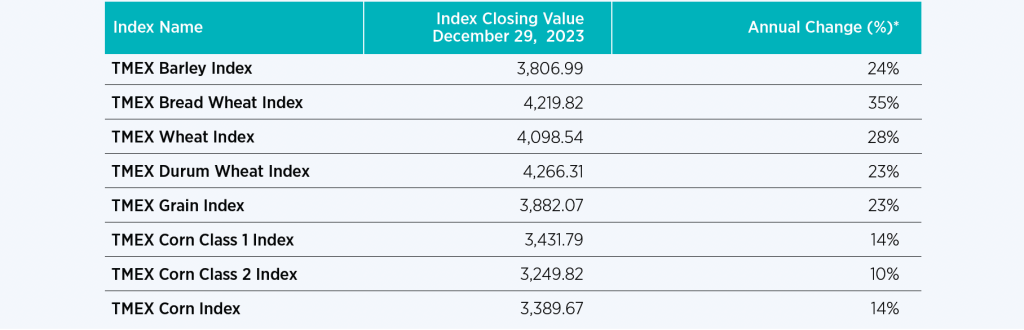

TMEX Agricultural Commodity Indices: The pulse of agriculture, the compass for farmers and investors.

TMEX Agricultural Commodity Indices keep the pulse of the agricultural sector. With the introduction of barley, wheat, corn and grain price indices, which were first published on 14 July 2021, the main direction of the agricultural commodity market in Türkiye can be tracked.

TMEX Agricultural Commodity Indices serve as benchmarks in financial instrument issuances. In this context, the issuance of Asset-Backed Securities (ABS), which is the first financial product in which TMEX Wheat Bread price index was used as a benchmark for calculating the periodical returns, was carried out on 23.06.2023. With the issuance carried out by Tarfin Tarım A.S. through Pasha Investment Bank and with the consultancy of OMG Capital, an important step was taken in the agricultural sector and the first financial product based on the bread wheat price index was introduced

to the market.

TMEX plays a crucial role in shaping the agricultural ecosystem by providing an e ective trading platform for healthy and realistic price formation, contributing to the development of financial instruments based on agricultural commodities, enhancing farmers’ access to finance, and supporting

the sector’s sustainable growth.

TMEX Research & Development Center: Inclusive and innovative solutions for the financialization of agricultural sector and accessing to finance.

The TMEX R&D Center is at the forefront of the TMEX Technological Transformation Project, introducing the TMEX Transaction System (TURIS), a domestic exchange solution for the agricultural market. The transition to TURIS, facilitated by Commodity Market Intermediary Institutions (CMII), is expected to be completed in the first half of 2024. This transition is supported by legislative groundwork laid out at the end of 2023, with detailed regulations to be finalized in 2024. E orts to launch futures contract trading on this platform will accelerate in 2024, aiming to operationalize the futures market by 2025.

Ensuring trust, free competition, and stability in the TMEX EWR Market transactions is paramount. To safeguard against economically or financially unjustifiable actions that may undermine market operation in terms of trust, transparency, and stability, TMEX conducts various market monitoring and surveillance activities. An R&D project, supported by the TÜBITAK 1005 National New Ideas and Products Research Support Program and aimed at implementing these activities with an AI-supported system, is scheduled for completion in 2024.

STATISTICAL INFORMATION

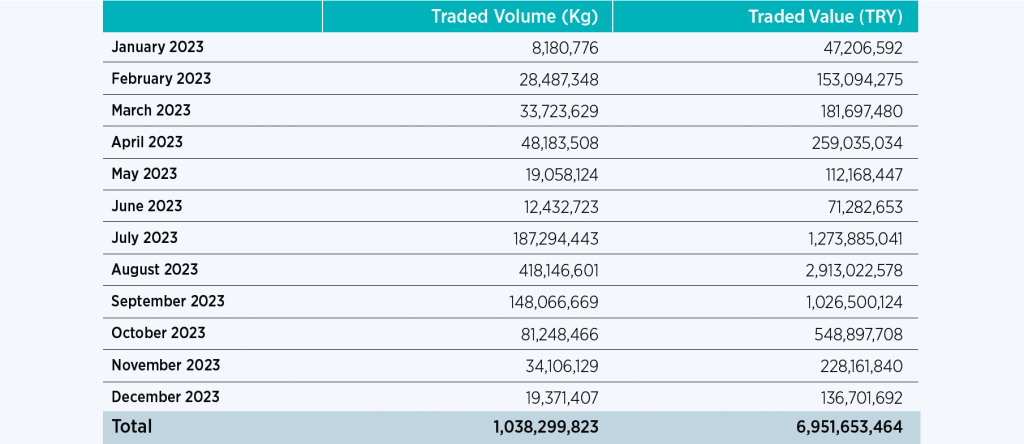

Table 1. 2023 EWR Market Statistics

Source: TMEX

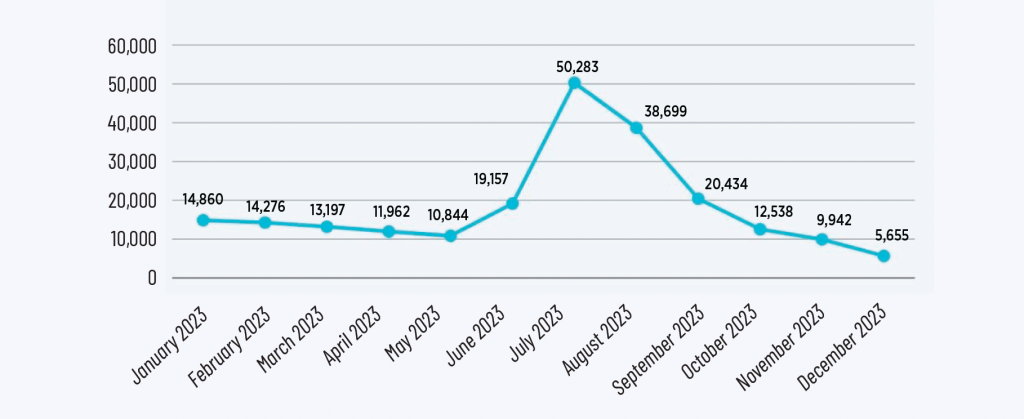

Graph 1. Number of Investors with EWR Holdings

Source: TMEX

Graph 2. Licensed Warehouse Capacity (December 29, 2023, Thousand Tons)

Source: Turkish Grain Board (TMO), T.R. Ministry of Trade

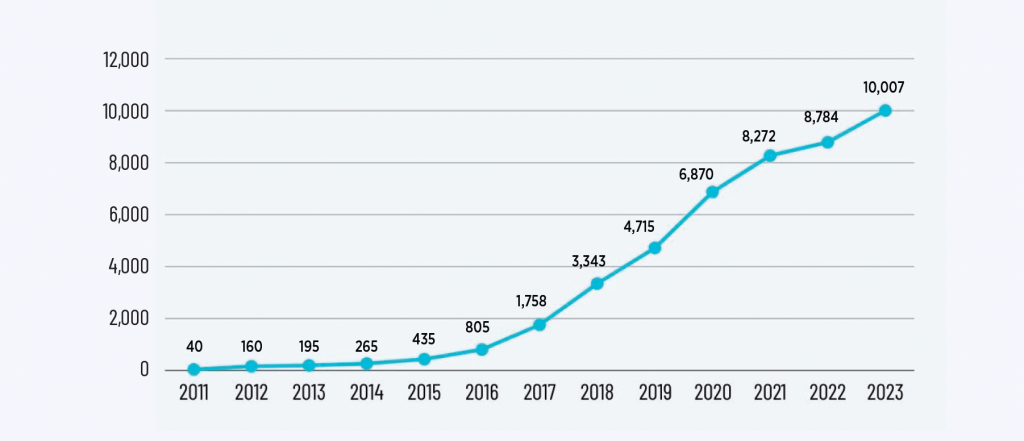

Graph 3. Number of Investors Registered in TMEX

Source: TMEX

Graph 4. EWR Market Total Traded Value by Commodity (2023)

Source: TMEX

Table 2. EWR Market Trading Figures by Commodity (2023)

Source: TMEX

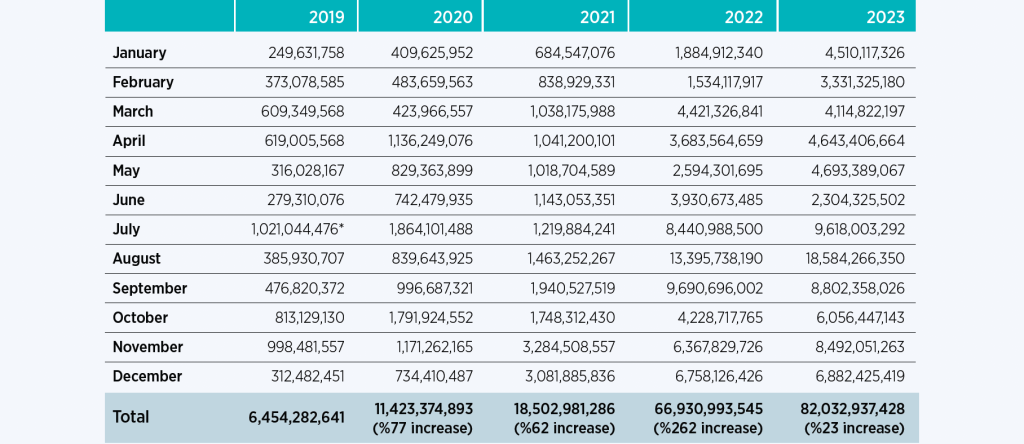

Table 3. The Traded Value (TRY) in EWR Market (2019-2023)

Source: TMEX

(*) TMEX EWR Market commenced operation on 26/07/2019. Data for the period before 26/07/2019 had been collected from

Istanbul Settlement and Custody Bank Inc. (Takasbank).

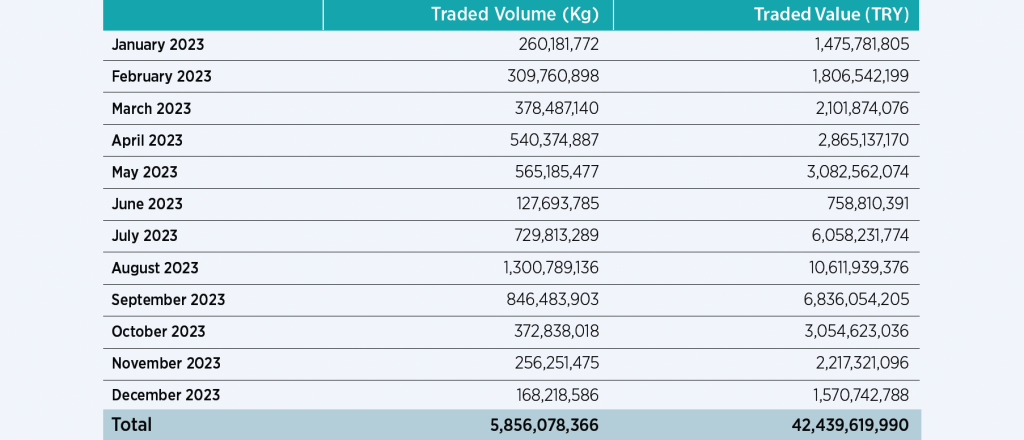

Table 4. EWR Market – Wheat EWR Monthly Trading Figures

Source: TMEX

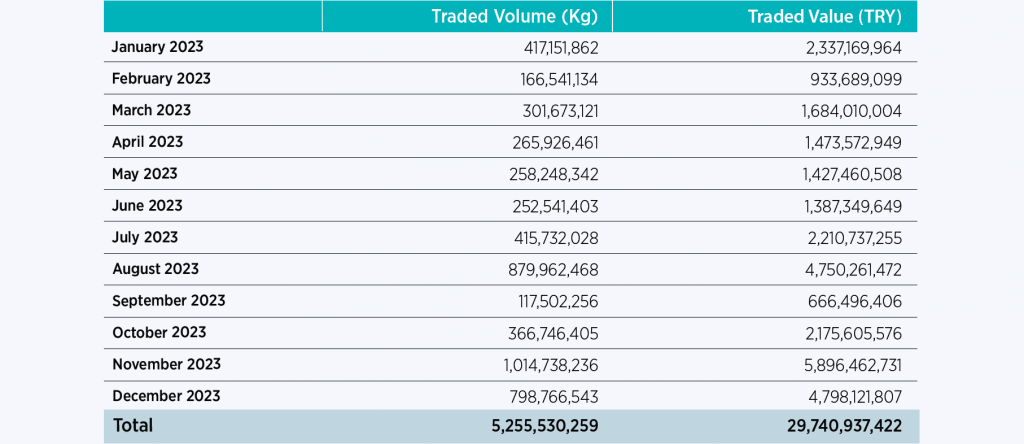

Table 5. EWR Market – Corn EWR Monthly Trading Figures

Source: TMEX

Table 6. EWR Market – Barley EWR Monthly Trading Figures

Source: TMEX

Table 7. TMEX Agricultural Commodity Indices

(*) Percentage changes from 30/12/2022 to 29/12/2023

Click here to download PDF format of TMEX EWR Market 2022

ELÜS İşlem ve Takas Süreçleri için tıklayınız

ELÜS ISIN kodlarına ulaşmak için tıklayınız.

TÜRİB ELÜS Piyasası Ücret Tarifesine ulaşmak için tıklayınız.

TÜRİB ELÜS Piyasası Ücretleri ve Fon Payı Hesaplaması için tıklayınız

TÜRİB Hakkında

2018 yılının Haziran ayında kurulan TÜRİB; lisanslı depo işletmecilerince oluşturulan elektronik ürün senetleri ile elektronik ürün senetlerine dayalı vadeli işlem sözleşmelerinin ticaretinin yürütülmesini sağlamak üzere borsacılık faaliyetinde bulunmaktadır. TÜRİB, tarladan sofraya gıda tedarik zincirinin dijitalleşmesi, ELÜS’ün yaygınlaştırılması, sözleşmeli tarımın gelişmesi, lisanslı depoculuk gibi alanlarda Türkiye Odalar ve Borsalar Birliği, T.C. Ticaret Bakanlığı, T.C. Tarım ve Orman Bakanlığı, T.C. Hazine ve Maliye Bakanlığı ve diğer paydaşlar ile iş birliğini sürdürmektedir.