2025 Annual Bulletin

Electronic Warehouse Receipt Market 2025 Bulletin

TMEX EWR Market has recorded a trading value of 372.2 billion Turkish Liras since the commencement of its operations.

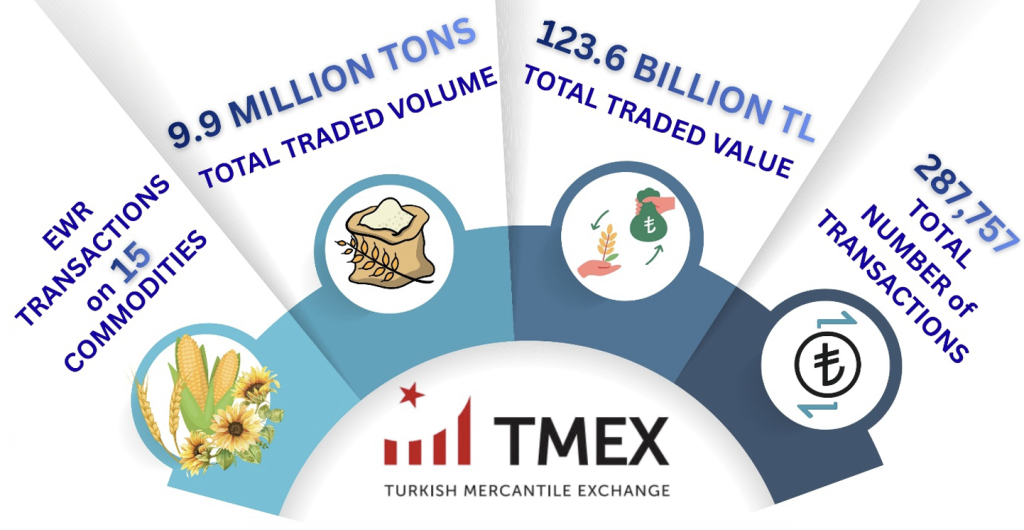

In 2025, the Electronic Warehouse Receipt (EWR) Market reached a trading volume of 9.9 million tons and a total trading value of 123.6 billion TL in more than 280 thousand EWR transactions. Since TMEX commenced operations on July 26, 2019, it has recorded more than 1.5 million EWR transactions, a cumulative trading volume of 57.3 million tons and trading value of 372.2 billion TL.

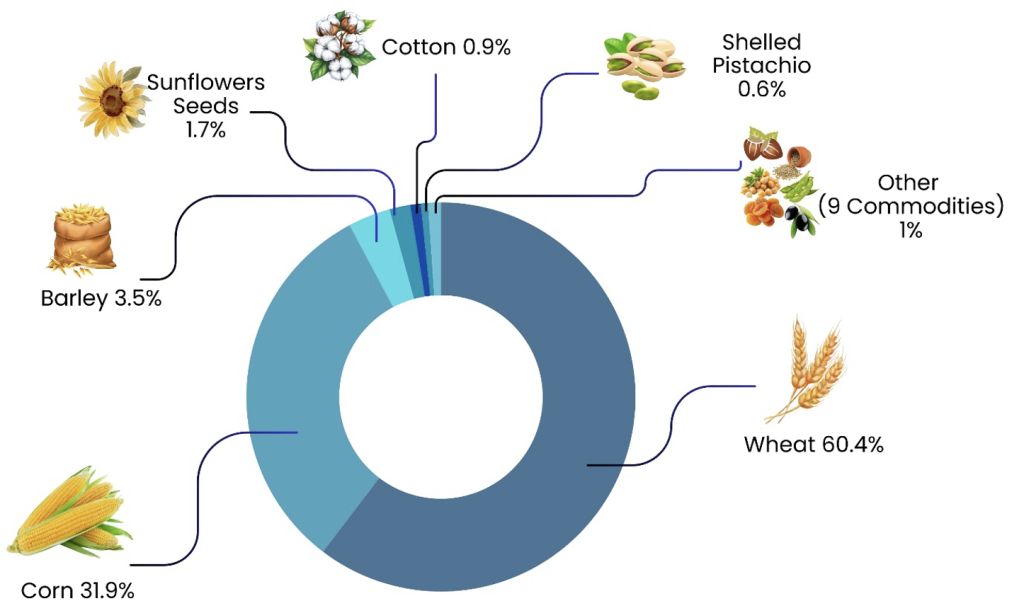

EWR is an electronic receipt that represents agricultural products stored in licensed warehouses and can only be traded in the TMEX EWR Market. In 2025, EWRs representing 15 different products, including wheat, corn, barley, pistachios, legumes, hazelnuts, dried apricots, cotton, olives, and oilseeds, were traded on the TMEX EWR Market, in order of trading volume. Following the publication of quality criteria by the Ministry of Trade, seedless raisin were also added to the range of products that can be traded on TMEX.

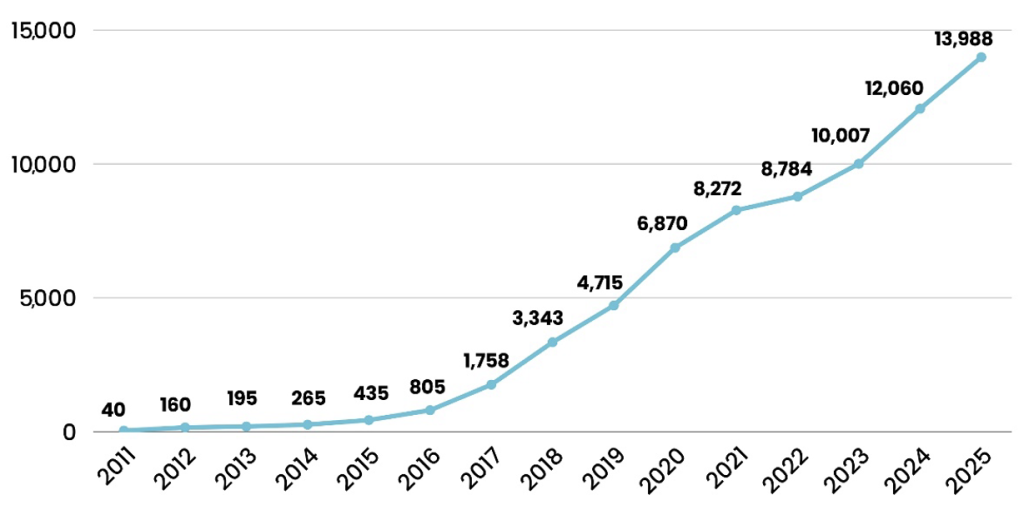

Licensed warehouses, where the products represented by EWRs are stored, are one of the fundamental elements of the mercantile exchange ecosystem. A total of 265 licensed warehouses operates in 54 provinces, 165 districts, and 363 different locations, with a combined storage capacity of 14 million tons. When TMEX commenced operations in 2019, the storage capacity was 4 million tons, and it has increased 3.5 times over the past six years. As of the 2025-year end, licensed warehouses reached a storage capacity of approximately 37% of Turkey’s grain harvest. The medium-term target is to reach a capacity of 18 million tons.

TMEX Agricultural Commodity Indices: The Pulse of Agriculture, the Compass for Farmers and Investors.

TMEX Agricultural Commodity Indices continue to keep the pulse of the agricultural sector. With the introduction of barley, wheat, corn and grain price indices, which were first published on July 14, 2021, the main direction of the agricultural commodity market in Türkiye can be tracked.

TMEX Agricultural Commodity Indices can be used as a benchmark in financial instrument issuances. In this context, Türkiye’s first lease certificate (sukuk) was issued using the TMEX Wheat Bread Price Index, which is calculated based on bread wheat transactions in the TMEX EWR Market. While this step was recorded as an important innovation in financing sources for farmers, it also brought the second financial product to the Turkish financial market: the issuance of asset-backed securities (ABS) based on the TMEX Wheat Bread Price Index.

Our Exchange continues to fulfill its mission of creating an efficient trading platform that ensures fair and transparent price formation in the agricultural market, thereby playing a key role in shaping the agricultural ecosystem. The prices formed on our Exchange contribute to farmers’ access to financing, the stable growth and sustainability of the agricultural sector, and the development of financial instruments based on agricultural commodities, creating a solid foundation for transformation within the industry.

TMEX Research & Development Center: Inclusive and Innovative Solutions for the Financialization of Agricultural Sector and Access to Finance.

TMEX Trading System, developed using TMEX’s own resources as a domestic and national exchange solution for the agricultural market within the scope of the TMEX Technological Transformation Project carried out by the TMEX R&D Centre, was successfully launched on January 13, 2025. With this system, commodity market intermediary institutions (CMIIs) have begun intermediating EWR transactions. It is expected that CMIIs will expand the investor base and product range and enhance market depth through their networks across Türkiye, together with the Commodity Exchanges, who are their shareholders and serve as their agents. The aim of introducing the intermediary system is to enable CMIIs to offer value-added intermediary services to market participants. The TMEX Trading System integrates seven Commodity Market Intermediary Institutions, eleven clearing and settlement service providers, three data vendor companies, İstanbul Settlement and Custody Bank Inc. for clearing, risk, collateral and default management services, and Central Securities Depository Co. Inc. as the electronic registry.

Work to enable futures contracts based on EWRs and TMEX Agricultural Commodity Price Indices and indicators to be traded via the TMEX Trading System is scheduled to be completed in the second half of 2026, with the launch of the TMEX Futures Market planned for that period.

To ensure that transactions in the TMEX EWR Market are conducted in an environment of trust, free competition, and stability, the Exchange carries out various market monitoring and surveillance activities to detect actions that cannot be reasonably explained on economic or financial grounds and that could disrupt the market trust, transparency, and stability. The Artificial Intelligence Supported Market Surveillance Project, supported by TUBITAK’s “1005-National New Ideas and Products Research Funding Program”, was successfully completed and the Algorithmic Detection and Monitoring Platform (ADMP) was integrated into the TMEX trading system. Work on integrating ADMP into the Futures Market will continue in 2026.

The TMEX International Commodity Market, is planned to be launched in the first quarter of 2026. Development and regulatory work for the market, where agricultural products in customs warehouses licensed by the Ministry of Trade (Ministry) will be listed on our Exchange and traded in USD and EUR, has reached its final stage. The Ministry granted an operating permission to the Market in 2025.

The TMEX Tawarruq Market, designed for short-term funding through the trading of electronic warehouse receipts (EWRs) compliant with participation finance principles, is planned to be launched in 2026. Work is ongoing to address the financial regulatory requirements necessary for its implementation.

The new markets will offer farmers, traders and industrial producers opportunities for risk management, while providing investors with instruments to diversify their portfolios. Thanks to the integrated market structure and enhanced oversight infrastructure, transparency, trust and corporate sustainability standards will be raised to the highest level.

TMEX meets International Standards in Information Technology Services.

In 2025, TMEX obtained the ISO/IEC 27001:2022 Information Security Management System Certificate and the ISO/IEC 20000-1:2018 Information Technology Service Management System Certificate, demostrating that the information security and service quality of the markets it operates are managed in accordance with international standards. With these certifications, TMEX ensures the information security of its markets and provide sustainable quality management across all information technology services, from financial market applications and market surveillance, to data dissemination and index calculations.

STATISTICAL INFORMATION

Graph 1. 2025 EWR Market Statistics

Source: TMEX

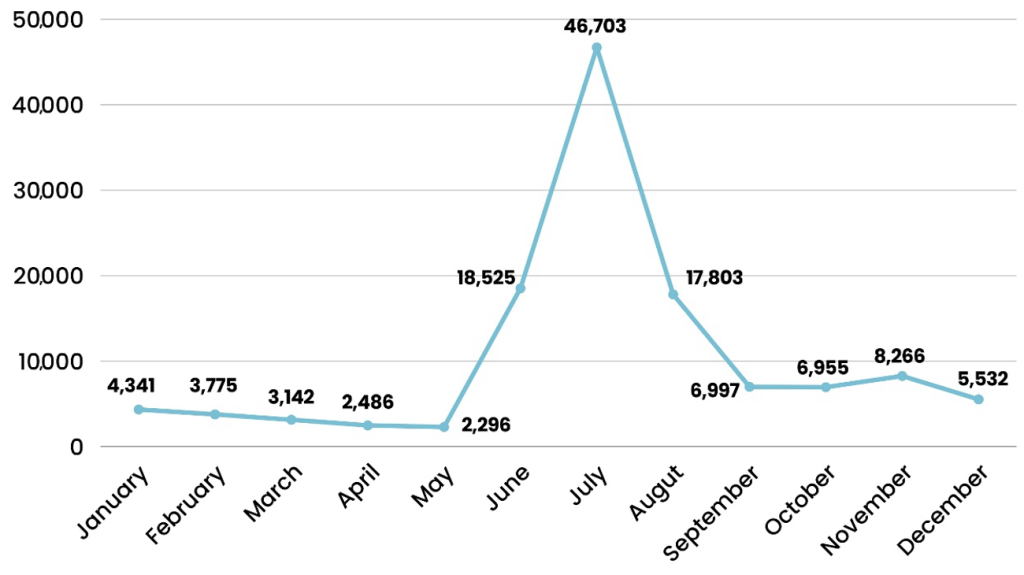

Graph 2. Number of Investors with EWR Balance Accounts in 2025

Source: TMEX

Graph 3. Licensed Warehouse Storage Capacity (Thousand Tons)

Source: T.R. Ministry of Trade

Graph 4. EWR Market Transaction Volume by Product in 2025

Source: TMEX

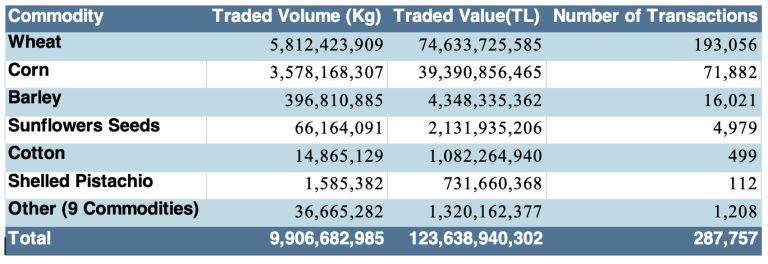

Table 1. EWR Market Transaction Information by Product in 2025

Source: TMEX

Table 2. The Traded Value (TRY) in EWR Market (2019-2025)

Source: TMEX

(*) TMEX EWR Market commenced operation on July 26, 2019. Data for the period before July 26, 2019 had been collected from Istanbul Settlement and Custody Bank Inc. (Takasbank).

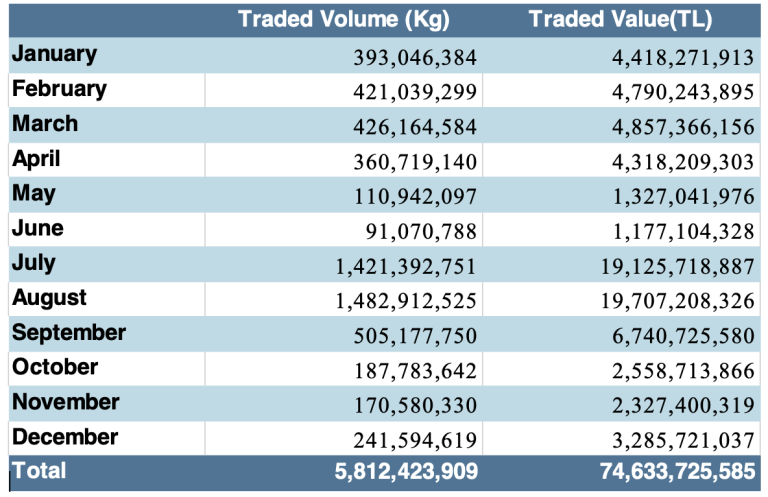

Table 3. EWR Market – WHEAT EWR Monthly Trading Figures in 2025

Source: TMEX

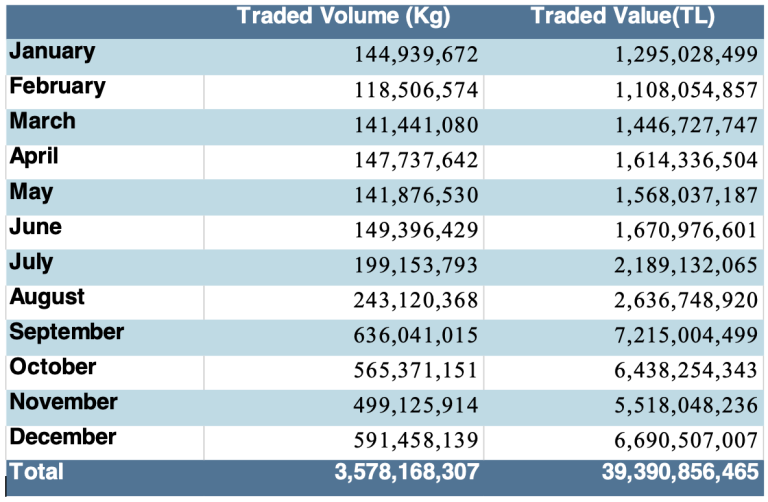

Table 4. EWR Market – CORN EWR Monthly Trading Figures in 2025

Source: TMEX

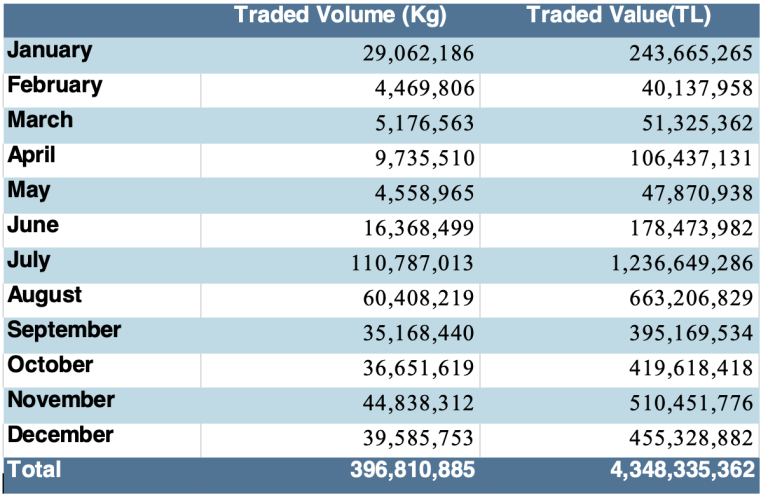

Table 5. EWR Market – BARLEY EWR Monthly Trading Figures in 2025

Source: TMEX

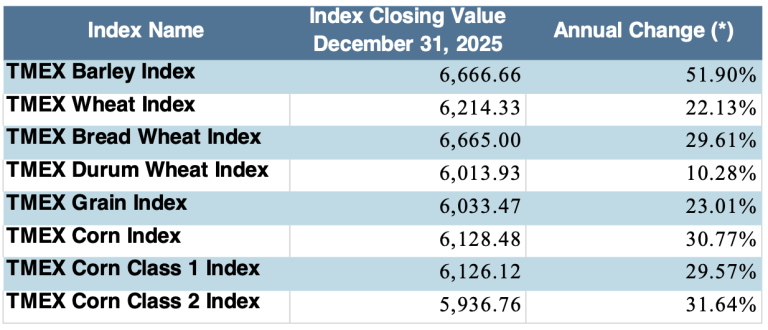

Table 6. TMEX Agricultural Commodity Indices

Source: TMEX

(*) Percentage changes from December 31, 2024 to December 31, 2025.

Click here to download PDF format of TMEX EWR Market 2025

Please click for the EWR ISIN Codes

About TÜRİB

Founded in June 2018, TÜRİB is engaged in exchange operations for trading of electronic warehouse receipts and of futures contracts on electronic warehouse receipts issued by licensed warehouse operators.

TÜRİB is working in collaboration with the Union of Chambers and Commodity Exchanges of Turkey (TOBB), T.R. Ministry of Trade, T.R. Ministry of Agriculture and Forest, T.R. Ministry of Treasure and Finance and other stakeholders in such fields and for such purposes as digitalization of food supply chain from field to fork, popularization and generalization of EWRs, development of contracted agriculture, and licensed warehouse operations.